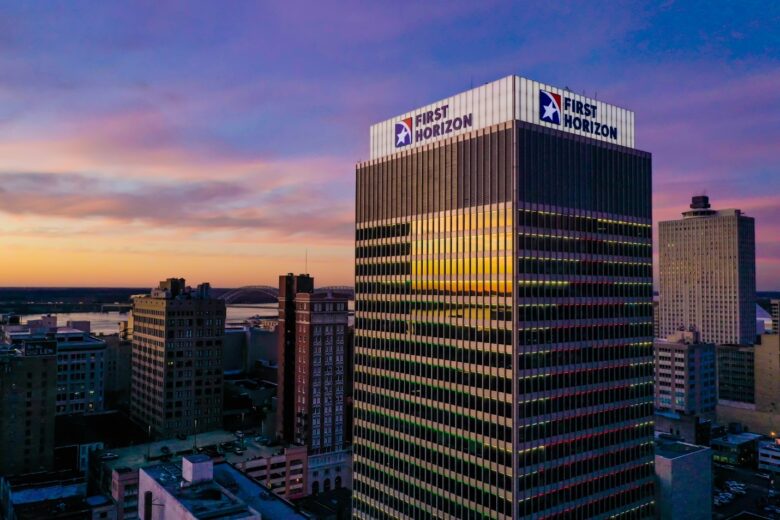

12 states, 750 agents, 5,500 total employees, roughly 20,000 endpoints, and more than 1.1 million customers. With numbers like that, First Horizon Bank knows how important it is to stay on the same page. From checking accounts and mortgages to credit cards and mobile banking, First Horizon caters to every aspect of a customer’s personal financial needs. As one of the leading financial institutions in the southeastern United States, the bank is dedicated to providing an innovative, convenient, and helpful banking experience.

Making the jump to a cloud-based contact center

When it comes to quality service and support, First Horizon’s contact center is at the heart of the operation. Its contact center is so essential for banking that First Horizon smartly invested in creative improvements to the customer experience. The bank had already started leveraging an interactive voice response (IVR) system. This tool allowed First Horizon to offer customers a self-service option instead of waiting to be helped by a contact center agent. However, as time went on the bank’s self-service solution became outdated, according to Jason O’Dell, Vice President for Voice Services Manager. The way he sees it, contact centers and IVRs are generally a “set it and forget it” product for many organizations. “But that doesn’t work with today’s world,” O’Dell argued. “Customers are evolving in what their expectations are and what they need because of their ‘right here, right now’ mentality.” So, O’Dell started searching for a solution that could evolve alongside their customers. At first, First Horizon looked only at on-premise solutions. But two years later, it still hadn’t found the right technology. After an acquisition of 30 branches in 2020, and another merger with IberiaBank on the horizon, O’Dell knew they needed to make a switch as soon as possible. “We found our existing system very difficult to maintain, manage, and add users,” he explained. “We knew we had to find a solution to rectify how fast we onboard individuals, train them, and get them licensed to use the product.” Fortunately, First Horizon was already a Cisco Call Manager customer. After reviewing its options, the bank chose to leverage its existing relationship with Cisco and introduce the cloud-based Webex Contact Center. After years of searching, O’Dell and his team finally had their ideal platform.Fast and easy implementation

First Horizon officially transitioned to Webex Contact Center in March 2021. In the cloud, O’Dell was able to streamline onboarding instead of setting up every user individually—a huge asset while completing the Iberia merger. “We actually onboarded 1,500 agents in just five to 10 minutes by being able to import, create, and skill users appropriately,” he said. “After a 15-minute training video, those individuals were operational with what they needed to answer customers during the merger and acquisition so that we didn’t have excessively long wait times for our new customers.” According to O’Dell, this was one of the biggest reasons they chose Webex Contact Center. He says that with any product, you want to get everybody on the platform as quickly as possible so that you can tweak and add new features. Because Webex enabled him to implement the solution incrementally, he didn’t have to do “the whole shabang” all at once. This meant he could add different features and functionalities without sacrificing the customer experience. In fact, First Horizon has increased its self-service rate with Webex, reversing some steady declines they’d been seeing in recent years. “We’re seeing a monthly self-service rate average of 87%, meaning that more customers aren’t always having to get an agent to deal with everything they need,” said O’Dell. In other words, First Horizon is helping customers reach a resolution without needing the assistance of a live agent. Meanwhile, agents have more time to work on harder issues that other customers couldn’t take care of over the phone or through self-service, further improving their banking experience.Simplifying collaboration across a growing business

Today, First Horizon is “all in with Webex branded products,” according to O’Dell. In addition to Webex Contact Center, First Horizon is also leveraging Webex Events to host monthly virtual events that keep customers informed about what’s going on at the bank. And during the pandemic, when many of the company’s contact center agents began working remotely, Webex Meetings and the Webex App played an important role in keeping everyone connected. According to O’Dell, First Horizon had about 200 Webex users before the pandemic. To date, it’s reached over 1,800 active users every month. Because some executives still worked in the office, First Horizon installed telepresence in three more meeting rooms. This allowed in-office and remote executives to collaborate while maintaining social distance across multiple conference rooms. O’Dell purchased Webex Rooms Kits and cameras to ensure video quality, features, and functionality were at their best. As the default softphone for the entire organization, the Webex App reduces the number of applications First Horizon needs to troubleshoot and manage on a daily basis. Now, agents have one phone number no matter where they’re working on any given day. “Folks are able to work from home and still have all the same features and functionality as if they were sitting at their desks,” O’Dell explained. “Webex has made for a smooth transition and utilization of services.” Although he appreciates the benefit of having one tool to simplify the agent experience, O’Dell also enjoys the ability to integrate other products with the Webex collaboration suite. This not only lets First Horizon onboard new tools as it sees fit, but also helps the company connect to external third parties.“An openness to work with competitors is critical for a collaboration platform,” said O’Dell. “By joining forces and working with partners, it helps keep Webex a frontrunner and leader because it can integrate with open platforms to ensure that tools are always staying current and maintaining stability.”