In 2019, Cover-More found itself in a challenging position. The company is part of Zurich Insurance group – a global travel insurance company – and it was busy serving its 15 million plus customers globally. But like any other successful company, it was also adjusting and trying to anticipate the ever-changing business landscape to stay competitive. And then the pandemic hit. We all know what that has meant to the world economy – but the travel industry was one of the hardest hit, especially at the outset. “Once everyone was safely home – we immediately pivoted to the future. What do we need to do to come back stronger in travel, and that really started with the customer,” says Cover-More Group CEO Cara Morton.

Accelerating time with Webex Cloud Calling and Contact Center

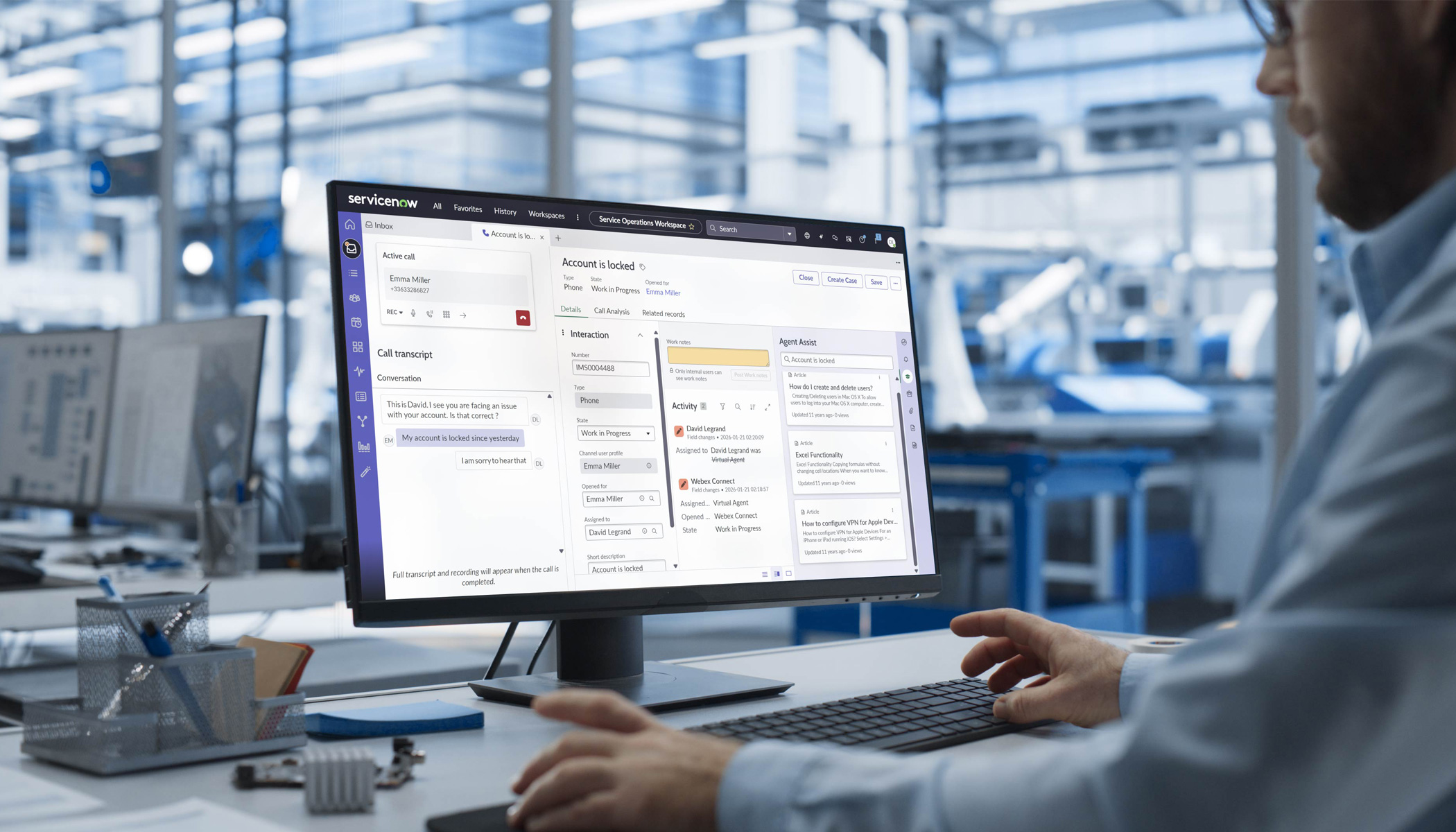

Cover-More’s culture was proactive and forward thinking. They were not going to count the days until travel would resume. In fact, discussions around hybrid work and upgrading systems had already begun for Cover-More. The pandemic simply accelerated the timeline. The company needed to upgrade its technology stack to better integrate systems and processes. They wanted a Cloud solution. And while they were at it, they wanted to look at how to better serve their customers. “Webex helped us really think outside the box,” explains James Hill – Global Manager, Infrastructure and Cloud. After a thorough evaluation process, Cover-More selected Webex Contact Center and cloud calling and successfully launched them across their entire global customer service network in just one day. Webex offers an omnichannel solution that is intuitive, with real-time global reporting – plus data analytics. “We never had metrics before! Webex Contact Center has given us the ability to look at the data, in terms of where the customers are coming from, and essentially how we are going to better service them,” Hill adds. “It’s very intuitive, it’s much easier to use. We can now report on everything we need to, globally.”Improving customer experience one communication at a time

Not only has the entire workflow improved, but Cover-More is providing superior customer service too.

“Our customers won’t necessarily want to just call us – they may want to email us – or SMS – they might want to use chat – they might want to use Facebook. Webex gives us that ability to have that discussion on how we’re going to better serve our customers,” explains Hill.With Webex, Cover-More was able to migrate nearly 300 agents, upgrade its IT stack, streamline workflows, and make travel insurance more accessible by integrating with its business partners. “By removing all the old stuff, and moving to Webex, we actually saved over 30 percent on our operating costs year over year,” Hill says. The future is looking bright for Cover-More. Hill continues, “As a business, we’re going to get phenomenally busy. And I’m really excited to see what Webex can do in terms of creating better customer experiences going forward.” Explore all that Webex’s customer experience solutions have to offer and see how we can help you better your business. Learn more Rethinking ‘contact center’ technology in the travel insurance industry Three considerations to get started on the digital messaging journey Orchestrating the world’s best customer experiences with Webex Connect